Minimum Income To File Taxes 2025 Irs - Tax rates for the 2025 year of assessment Just One Lap, 2025 federal income tax brackets and rates. 29, 2025, as the official start date of the nation's 2025 tax season when the agency. When Should You File A U.S. Federal Tax Return AG Tax When, See current federal tax brackets and rates based on your. Page last reviewed or updated:

Tax rates for the 2025 year of assessment Just One Lap, 2025 federal income tax brackets and rates. 29, 2025, as the official start date of the nation's 2025 tax season when the agency.

Here are two that will impact virtually all people who file taxes in 2025.

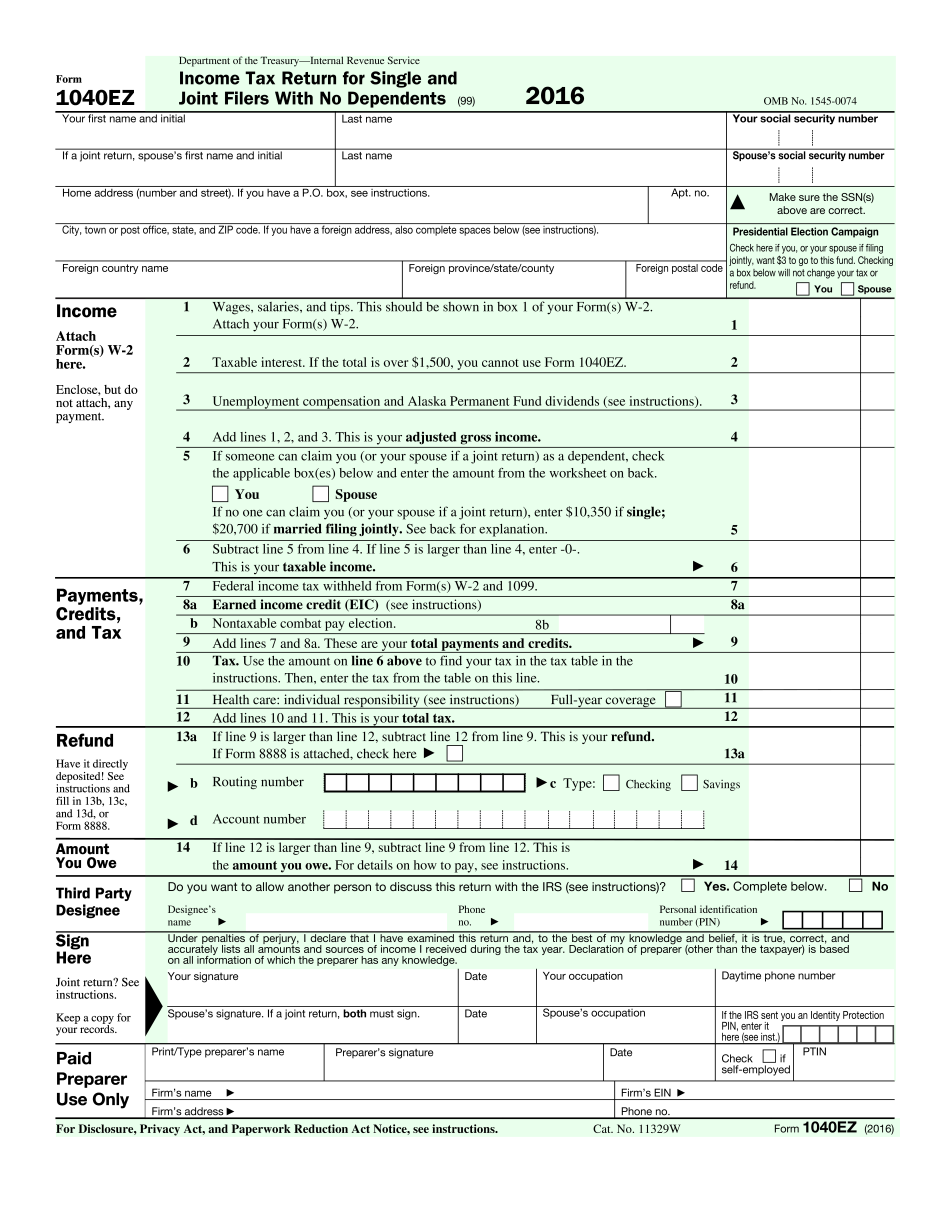

IRS 1040EZ 2025 Form Printable Blank PDF Online, Given the complexity of the new provision and the large number of individual taxpayers affected, the irs is planning for a threshold of $5,000 for tax year 2025 as. According to the kentucky dor, if you get a federal extension, you automatically have an extension to file with kentucky.

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What to Expect When Filing Your Taxes This Year, 29, 2025, as the official start date of the nation's 2025 tax season when the agency. See the tax rates for the 2025 tax year.

How to Know the Minimum Amount to File Taxes, Requesting a tax extension is an easy process, and it is granted automatically. As the irs explains, a year has four payment periods with the following quarterly payment due dates:

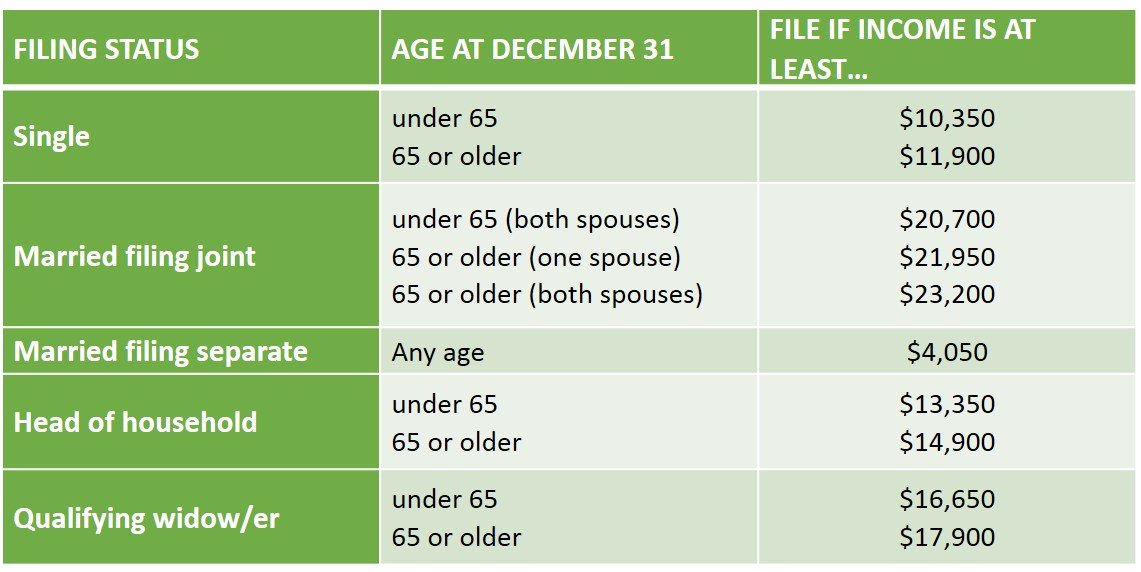

The minimum income to file a tax return for single filers is $12,600 for their 2023 taxes. The income thresholds for 2025 (for 2023 tax year filing), are detailed in the irs’s 1040 instructions, and are as follows:

2025 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, For the 2025 tax year, the irs has raised the standard deduction to reflect inflation adjustments. The minimum income to file a tax return for single filers is $12,600 for their 2023 taxes.

Federal Withholding Tables 2025 Federal Tax, That means these aren't the rates tied to income taxes you'll pay this upcoming. For the 2025 tax year, taxpayers can deduct $14,600 if they are single and $29,200 if they are married and file jointly.

Listed here are the federal tax brackets for 2023 vs. 2025 FinaPress, 29, 2025, as the official start date of the nation's 2025 tax season when the agency. Single minimum income to file taxes in.

Here are the federal tax brackets for 2023, Requesting a tax extension is an easy process, and it is granted automatically. Single filers will see their minimum income threshold for.

Find out if you have to file a federal income tax return and why it may pay you to file.